Before you discover what type of member you are, it is helpful to understand the historical types of membership that we have within the GKN Schemes. Please select and see descriptions for each type of membership here.

A DB scheme pays a benefit based on salary and years of active membership. The trustees of a DB scheme choose how contributions are invested, which does not impact how members’ pension benefits are calculated.

The pension income a member will be paid at retirement is calculated using the member’s accrued pensionable service and final pensionable salary. For GKN benefits, this only applies to benefits accrued before 01/09/2007, when the scheme converted from a final salary to a Career Average Revalued Earnings (‘CARE’) scheme. All GKN DB benefits are salary related but the Final Pensionable Salary link was severed on Pre CARE service on 05/04/2010 and all CARE benefits, only use earnings related to the year of accrual. DB benefits stopped accruing from 30 June 2017.

Members can choose whether or not to take tax-free cash when taking their pension, except for a small minority of members where legislation may restrict benefits to a pension only form.

The GKN Pension Group Scheme has a scheme element referred to as the 100+ scheme, for members that had accumulated benefits within either the DB or DC (or both) scheme sections before 1 July 2017.

Members with 100+ benefits will have a retirement account, along with their DB benefit, where regular DC contributions have been invested as per the member’s investment instructions. This account will form part of your retirement benefits.

As the defined benefits (DB) stopped from 30 June 2017, active members were provided with defined contribution (DC) benefits for future service. As they kept the DB benefit that had accrued, they have a "hybrid" of both benefits. The DC benefits are currently held in an Individual Pot with Legal & General.

Often members have accrued both DB and DC benefits, these are sometimes called hybrid benefits. For the GKN Group Pension Scheme, for example; members could have Deferred DB benefits but be Active members within the DC scheme section, or they could have deferred benefits in both the DB and DC scheme sections at the same time.

The GKN Group Pension Scheme closed for DB accrual from June 2017, so there are no active members in the DB Scheme section. Refer to the DB or DC definitions for more details on these types of benefits.

The Trustee offers members in a DC scheme a range of funds and the default fund is diversified to offer some protection against volatility, particularly nearer to retirement.

An Individual Pot is set up in a member’s name and an agreed level of employee and employer contributions are paid into this Individual Pot (monthly). Members choose from the available investment options and contributions are invested accordingly. The default option is in place for anyone not wanting to make an investment decision. The value of each member’s retirement savings will change over time because of the amount contributed as well as the performance of the investment funds (they could go up or down) and charges.

Members are able to use their Individual Pot account to take cash, drawdown income or buy a pension, depending on their circumstances. The GKN Group Pension scheme does not allow the drawdown option but does allow you to transfer out your Individual Pot to another scheme that does provide this facility.

So you understand which type of membership you have, simply use this filter by answering some questions. If you have difficulty answering the questions, please contact +44 (0) 114 256 7774 and we will help you.

Which Section of the GKN Scheme did you join?

If you joined on or after 24 April 2013 you will more than likely have joined the DC Section

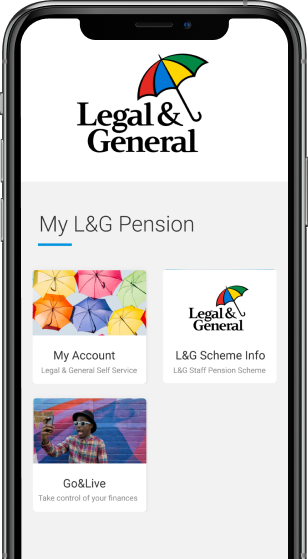

If you are a DC member of the GKN Schemes 1, 3 or 4, Legal & General have developed an app to give you quick access to your pension. Download the instructions to set it up on your mobile phones or tablets.

Following the acquisition of GKN (by Melrose Industries plc) in 2018, the GKN Group Pension Scheme 2012 was split into four new schemes in June 2019, with differing employer support. We now have four schemes with differing membership and benefits, shown below. If you know which scheme you are a member of, go to Newsletters & Statements for access to information on each scheme.